Collateralized Loan Obligations: Recognizing the Right Kind of Risk

Highland Capital Management’s Mark Okada explains the risks associated with CLOs, and why those who understand them may have an opportunity to generate attractive returns

Events at the end of 2015 brought notoriety to the high-yield credit market. With headlines like “Default danger for US high yield,” “Bad omen: Junk bonds are getting trashed” and “Bond Market Problems Have Financial Crisis Twist,” it is no surprise that the market saw such a major selloff in December.

Unfortunately, investors who indiscriminately fled the high-yield space may in due course find that they made the cardinal mistake of buying high and selling low. Conversely, the market can create opportunity for fundamental, patient investors who are willing to prudently provide capital while others flee. This is particularly pronounced in an increasingly illiquid market, which ultimately rewards these long-term capital providers with great returns.

Beyond this surface buying opportunity that arises from a largescale selloff, there is an underlying risk dynamic at play that makes this scenario particularly appealing to the astute investor; that is, a situation in which liquidity risk is misconstrued as fundamental risk.

Understanding fundamental risk: a case for CLOs

There is an ongoing debate regarding where we are in the credit cycle—and certainly recent price action harbingers an increase in default and refinancing risk. (At Highland, we believe the credit market is oversold and represents value.)

Part of this behavior can be attributed to energy and metals and mining, which have been increasingly troubled sectors. But looking broadly at the high-yield credit market, two-thirds of the industry groups overall have more than 10 percent of bonds trading at distressed levels. In each of these cases there is a mix of liquidity stress and fundamental stress taking place—both critical factors to consider in a turning credit cycle.

What is key, however, in this type of market, is thoroughly analyzing and understanding fundamental risks at the issuer level in credit. In the recent selloff, for example, much of the distress can be attributed to higher liquidity risk, which was largely mistaken for fundamental risk (hence the drastic headlines and equally drastic response from spooked investors). What many of those stories failed to report was that market-based liquidity issues only create fundamental problems when there are liquidity constraints at the issuer level, which is generally not the case at the moment.

Looking at the credit market in 2016, there appears to be a growing opportunity for investors to take liquidity risk and be handsomely rewarded without the threat of fundamental risk. In particular, collateralized loan obligation debt (CLOs) presents an opportunity to take the right kind of risk with sound fundamentals and generate attractive returns.

Problem sector protection and dislocation opportunities

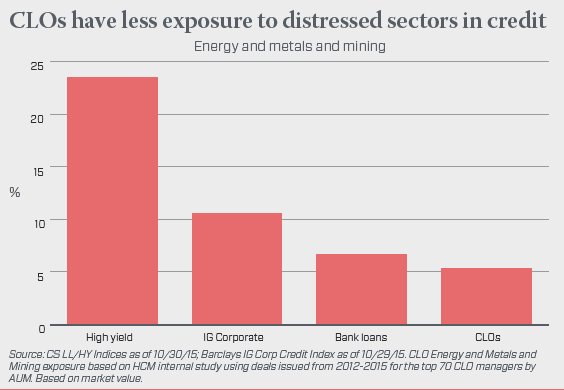

What makes CLOs appealing right now is the kind of protection that they provide from fundamental credit risk. Compared to high-yield bonds, in particular, CLOs are well-diversified across industries and have noticeably less exposure to the troubled energy and metals and mining sectors—around five percent exposure for CLOs, a stark contrast to the more than 23 percent exposure for high yield. As the accompanying graph illustrates, CLOs are also better protected from those problem sectors than both bank loans and investment-grade corporate bonds.

Nevertheless, CLOs have underperformed recently in light of broader technical issues in the credit market. The BBB and BB CLO indexes are now trading 219 and 394 bps wide to similarly rated high-yield bonds.

The strategic benefit of this recent performance is that, combined with the low fundamental risk in CLOs, it creates a dislocation that can produce attractive buying opportunities.

Default risk, structural soundness and an advantage in volatility

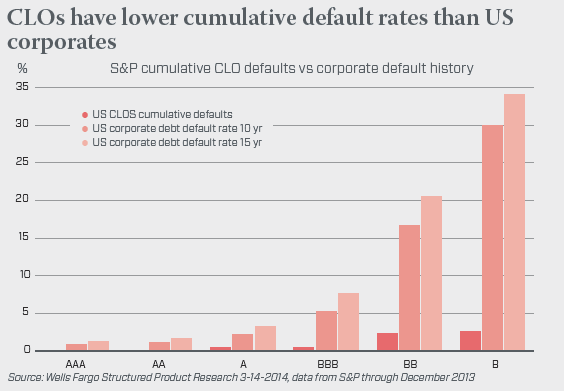

Risk of default is top of mind among credit investors, and in this important area, CLOs are likewise well positioned from a risk standpoint. CLOs have a strong track record when it comes to defaults, with a lower cumulative default rate than US corporates, as the below chart makes clear.

Furthermore, CLOs issued post-2008 have more robust structures than they ever have historically, which creates an additional level of security for investors. Despite the fact that CLOs performed well through the crisis, rating agencies reduced leverage in post-crisis CLOs, also known as CLO 3.0s, making the vehicle even more structurally sound. Since the creation of the CLO 3.0 product, no CLO tranche, from AAA- all the way down to BB-rated tranches, has suffered a principal loss—a major testament to the structural integrity of the asset class.

Adding to the stability of today’s new issue CLOs is the impact of the Volcker Rule, which eliminated bond and securities baskets, thereby simplifying and enhancing the collateral quality. Furthermore, the Federal Deposit Insurance Corporation (FDIC), under the Dodd-Frank Act, has mandated that all sponsors and issuers of CLOs retain at least five percent of the credit risk in CLOs issued beginning in December 2016. This mandate aligns interests and incentives with CLO managers, allowing them to share the risk alongside the investors.

Another significant feature of CLOs is the cash flow waterfall structure that both pays interest and amortizes sequentially starting with the highest rated tranches. While market shocks and mark-to-market volatility can impact the pricing of assets within the portfolio and result in stress to the equity and lower rated tranches within the CLO, the CLO is structured to heal itself over time using the cash flow of the portfolio. It would take a 22 percent constant annual default rate for the life of a deal to create a loss in an A-rated CLO bond. That is a far-fetched scenario considering the long-term loan default rate is only 2.6 percent.

What makes these structural advantages so significant, especially in 2016, is that market volatility becomes the kind of opportunity described earlier for shrewd investors to step in and serve as liquidity providers for fundamentally solid credits. CLOs, because of their low default probability, are strong candidates for such an opportunity.

Interest rate risk and a positive supply/demand dynamic

The Federal Reserve’s historic decision to increase the federal funds rate in December 2015 now has most fixed-rate investors on their toes as they begin to anticipate the size and speed of future interest rate hikes. During a hiking cycle, there generally is a compression in credit spreads, which should create a positive technical for CLO debt.

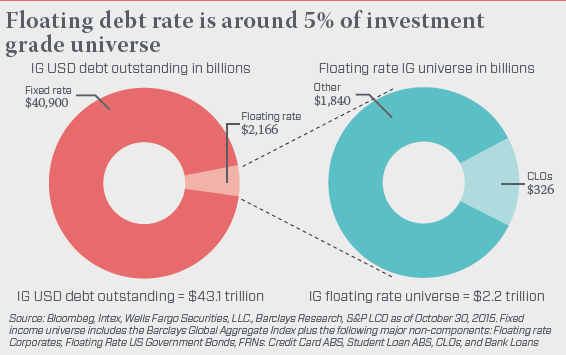

Adding to the appeal of CLOs in 2016 is that, as floating rate investments, they can be attractive in a rising interest rate environment like the one we are in as we begin the year. As a result, demand for CLOs is likely to increase as investors position portfolios to avoid interest rate risk by rotating out of core fixed income and into floating rate securities.

The impact of this would be amplified by the fact that quality floating rate debt, as the above charts reveals, is few and far between. On top of that, CLO issuance is expected to slow down in the coming months, as capital costs have increased and CLO equity is more challenging to raise in this environment.

The value here is how as these influences converge, they create a favorable supply/demand dynamic and subsequently a positive technical for CLO spreads.

Better risk, better yield: a winning combination

The biggest draw for CLOs is the protection they offer from fundamental risk. While liquidity risk may be present, we believe the fundamentals in CLOs are sound and therefore create a promising dislocation opportunity from broader market technicals.

CLOs also benefit from structural advantages that enable investors to capitalize on market volatility—an ability that will likely be critical for investors in 2016. And in a year marked by looming rate increases, CLOs also provide a sought-after floating rate debt option.

Full Story – Here